How to make money online with Cryptocurrency Mining

Cryptocurrency mining can be a way to potentially make money online, but it’s important to note that it’s not as straightforward as it used to be, and there are several factors to consider before getting started. Here’s a general outline of how to make money with cryptocurrency mining:

TODAY’S BEST DEALS

What is cryptocurrency mining?

Cryptocurrency mining is a crucial process that underpins digital currencies like Bitcoin and Ethereum. Think of it as the engine that keeps these currencies running smoothly. Here’s a more detailed explanation in 400 simple words:

At its core, cryptocurrency mining is about validating and recording transactions made with digital currencies on a decentralized network, called a blockchain. A blockchain is like a digital ledger that records every transaction ever made with that cryptocurrency. Unlike traditional banking systems where a central authority maintains the ledger, a blockchain is maintained by a network of participants, called miners, who work together to ensure the accuracy and security of the transactions.

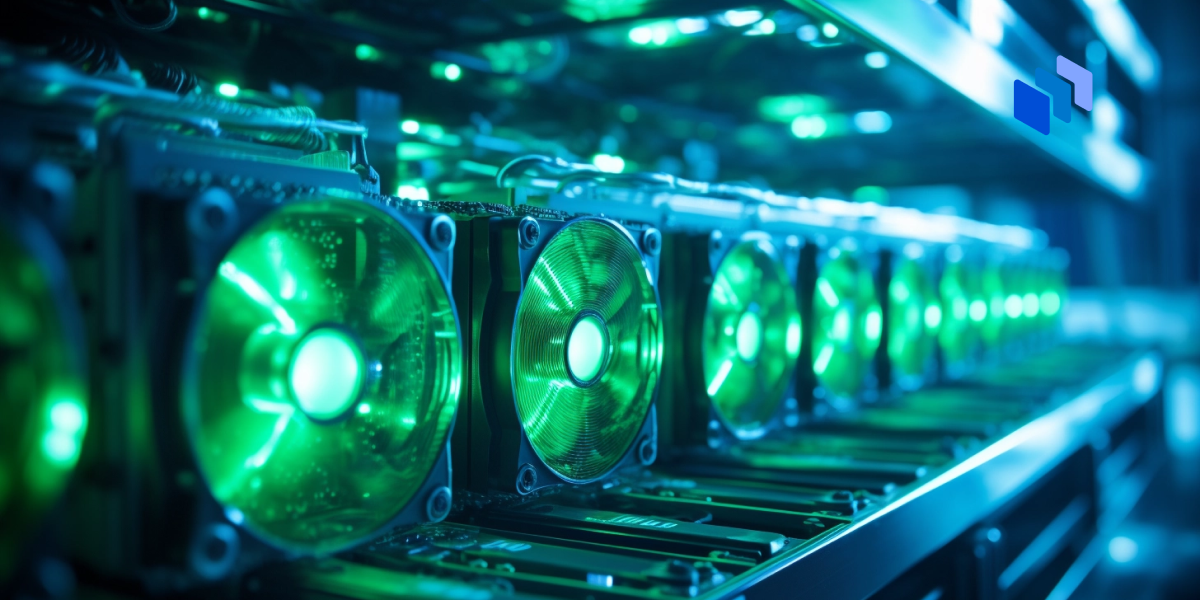

To become a miner, you need a powerful computer known as a mining rig. This rig is equipped with specialized hardware designed to solve complex mathematical puzzles. These puzzles are not arbitrary but are integral to the security and integrity of the cryptocurrency network. They prevent malicious actors from tampering with transactions and ensure that only valid transactions are added to the blockchain.

How the mining process works?

-

Verification: When someone initiates a cryptocurrency transaction, it’s broadcast to the network. Miners collect these transactions into a group called a block.

-

Puzzle Solving: Miners compete to solve a cryptographic puzzle based on the transactions in the block. This puzzle requires a huge amount of computational power to solve but is easy to verify once solved.

-

Proof of Work: The first miner to solve the puzzle broadcasts the solution to the network. Other miners verify the solution, and if it’s correct, the block is added to the blockchain. This process is called “Proof of Work” because the miner has to prove they did the work by solving the puzzle.

-

Reward: As a reward for their efforts, the miner who successfully added the block to the blockchain is granted a certain number of newly minted cryptocurrency coins and any transaction fees paid by users for their transactions. This is how new cryptocurrency coins are created.

-

Difficulty Adjustment: The puzzles are designed to become progressively harder over time. This ensures that blocks are added to the blockchain at a consistent rate, usually around every 10 minutes. As more miners join the network and the total computational power increases, the puzzles adjust in difficulty to maintain this rate.

However, mining isn’t a guaranteed way to make money. It requires substantial upfront investment in hardware and consumes a significant amount of electricity. As more miners join the network, the competition becomes tougher, making it harder to mine coins and receive rewards. Some cryptocurrencies, like Ethereum, are transitioning from Proof of Work to other consensus mechanisms like Proof of Stake to address the environmental concerns and scalability issues associated with mining.

In summary, cryptocurrency mining is the process of validating transactions and adding them to a blockchain by solving complex mathematical puzzles. It’s an essential part of maintaining the security and integrity of a cryptocurrency network while also creating new coins as a reward for miners’ efforts.

Choosing the right cryptocurrency

Choosing the right cryptocurrency to mine involves considering a few important things.

-

Popularity and Demand: Look for cryptocurrencies that are widely known and used. Popular ones are more likely to have stable value and be in demand.

-

Technology and Purpose: Understand what the cryptocurrency is designed for. Some focus on fast transactions, while others emphasize privacy or smart contracts. Choose one that matches your interests and needs.

-

Mining Difficulty: Check how hard the puzzles are to solve. If they’re too difficult, you might not earn much. If they’re too easy, more miners could join, reducing your rewards.

-

Hardware Requirements: Different cryptocurrencies need different types of computer hardware to mine effectively. Make sure your hardware is a good fit.

-

Energy Costs: Mining uses a lot of electricity. Check your energy costs and make sure your earnings will cover them.

-

Potential Profits: Consider the current value of the cryptocurrency and how much you might earn from mining it. Compare this to your costs.

-

Community and Development: A strong community and active development team can indicate a promising future for a cryptocurrency.

-

Market Stability: Cryptocurrency values can be very volatile. Think about whether you’re comfortable with potential price swings.

-

Regulations: Check if there are any legal or tax issues related to mining the cryptocurrency in your country.

-

Long-Term Outlook: Think about whether the cryptocurrency has a clear plan for the future and how it might adapt to changes in technology and markets.

-

Security: Ensure that the cryptocurrency has a secure network and hasn’t had major security breaches.

-

Ease of Use: Some cryptocurrencies have user-friendly mining software, while others require more technical skills to set up.

-

Environmental Impact: Mining certain cryptocurrencies can have a big carbon footprint. If you’re concerned about the environment, consider this factor.

Highlight potential profitability and growth prospects of various cryptocurrencies.

Certainly, here are some examples of cryptocurrencies with potential profitability and growth prospects. Keep in mind that the cryptocurrency market is highly volatile and subject to rapid changes. While these cryptocurrencies have shown promise, it’s important to do your own research and consider expert opinions before making any investment decisions.

- Bitcoin (BTC):

- Profitability: As the first and most well-known cryptocurrency, Bitcoin has significant value and recognition.

- Growth Prospects: Bitcoin’s limited supply (21 million coins) and its role as a store of value have contributed to its long-term growth potential.

- Ethereum (ETH):

- Profitability: Ethereum is not only a cryptocurrency but also a platform for creating decentralized applications (DApps) and smart contracts, leading to demand for its native currency, Ether.

- Growth Prospects: Ethereum’s transition from Proof of Work to Proof of Stake (Ethereum 2.0) aims to address scalability and environmental concerns, potentially boosting its value.

- Cardano (ADA):

- Profitability: Cardano focuses on scalability, sustainability, and interoperability, attracting attention for its innovative approach.

- Growth Prospects: Ongoing developments and a strong research-driven approach could contribute to Cardano’s growth in the smart contract ecosystem.

- Solana (SOL):

- Profitability: Solana offers high-speed and low-cost transactions, making it suitable for decentralized applications and DeFi (Decentralized Finance).

- Growth Prospects: Its growing ecosystem and technical advancements have positioned Solana as a potential contender for broader adoption.

- Binance Coin (BNB):

- Profitability: Binance Coin is associated with the Binance exchange and is used to pay for trading fees, which creates constant demand.

- Growth Prospects: Binance’s expansion and various use cases for BNB, including token sales and DeFi participation, could contribute to its growth.

- Polkadot (DOT):

- Profitability: Polkadot aims to enable different blockchains to work together, facilitating interoperability and scalability.

- Growth Prospects: Its unique approach to connecting blockchains and the potential for building complex applications could drive demand for DOT.

- Chainlink (LINK):

- Profitability: Chainlink provides decentralized oracle services, enabling smart contracts to access real-world data.

- Growth Prospects: The need for reliable data in DeFi and other applications has contributed to Chainlink’s adoption and potential for growth.

- Avalanche (AVAX):

- Profitability: Avalanche focuses on high throughput and interoperability, aiming to attract DeFi projects and applications.

- Growth Prospects: Its potential to address scalability and security concerns in decentralized applications could contribute to its growth.

Understanding to cryptocurrency minings hardwares

Certainly! Mining hardware comes in various forms, each with its own strengths and weaknesses. Here’s a breakdown of the four main types of mining hardware: CPUs, GPUs, ASICs, and FPGAs.

- CPUs (Central Processing Units):

- Function: CPUs are the primary “brain” of a computer, handling general-purpose tasks.

- Mining: In the early days of cryptocurrencies like Bitcoin, CPUs were used for mining. They can perform mining algorithms, but they are relatively slow and inefficient compared to newer options.

- Advantages: CPUs are versatile and can handle a variety of tasks beyond mining.

- Disadvantages: They are slow and not cost-effective for most cryptocurrency mining due to their low hash rates (computational power).

- GPUs (Graphics Processing Units):

- Function: GPUs are designed for rendering graphics in video games and other visual applications.

- Mining: Miners quickly discovered that GPUs could perform mining algorithms much faster than CPUs. They became popular for mining due to their parallel processing capabilities.

- Advantages: GPUs are more powerful than CPUs for mining and can be used for other tasks as well.

- Disadvantages: They consume a significant amount of power and can get hot during extended mining operations.

- ASICs (Application-Specific Integrated Circuits):

- Function: ASICs are specialized hardware designed specifically for a single task, such as mining.

- Mining: ASICs are highly efficient for mining because they are optimized to perform a specific algorithm. They are particularly common in Bitcoin mining.

- Advantages: ASICs offer the highest hash rates and energy efficiency for mining.

- Disadvantages: They are expensive to purchase and are limited to mining specific cryptocurrencies. If the algorithm changes, ASICs can become obsolete.

- FPGAs (Field-Programmable Gate Arrays):

- Function: FPGAs are programmable integrated circuits that can be customized for specific tasks.

- Mining: FPGAs offer a balance between GPUs and ASICs. They can be reprogrammed for different mining algorithms, making them more adaptable than ASICs.

- Advantages: FPGAs are more energy-efficient than GPUs and offer some degree of flexibility in adapting to algorithm changes.

- Disadvantages: They are less efficient than ASICs for specific algorithms and require technical knowledge to program effectively.

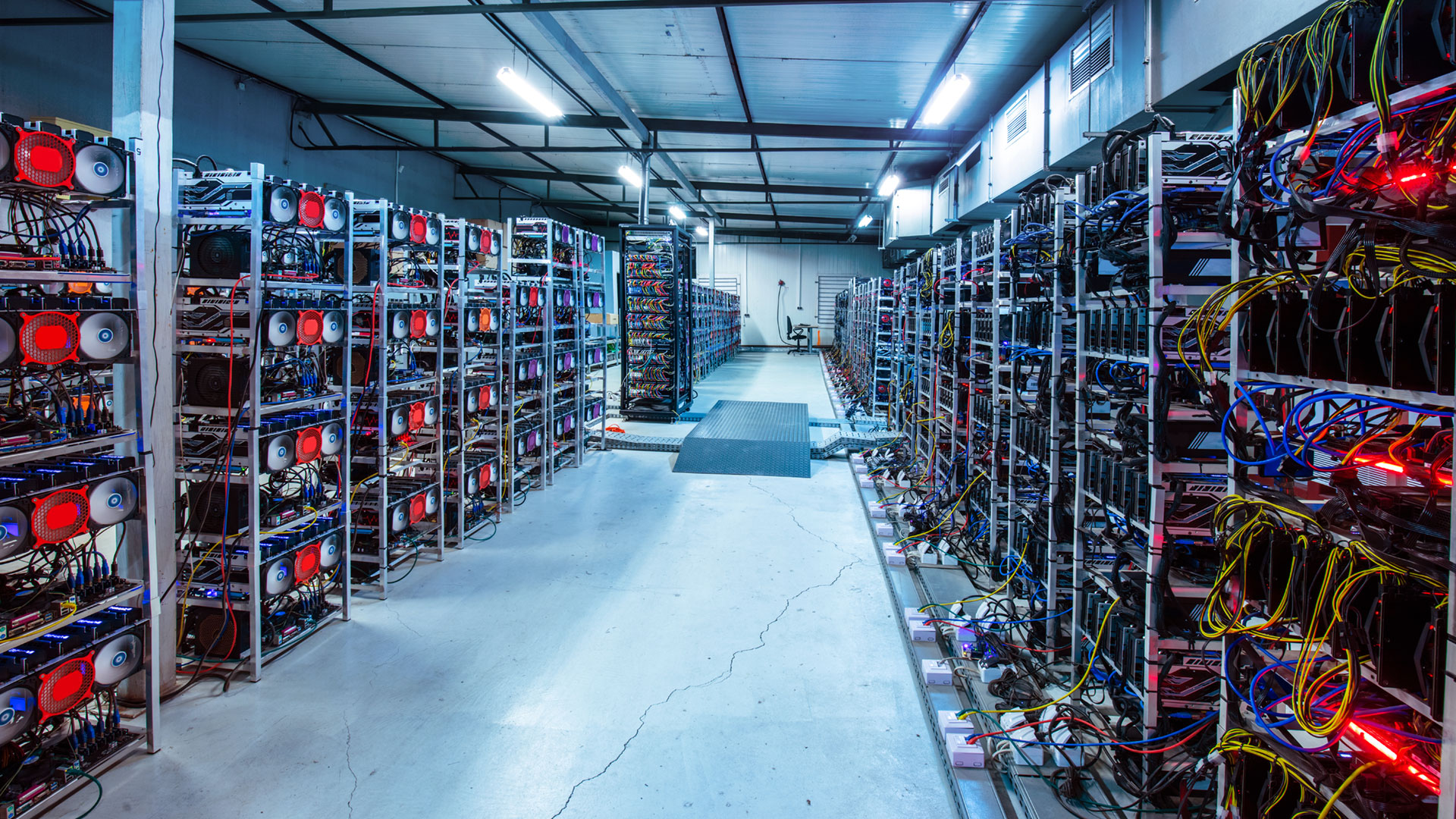

Joining Cryptocurrency Mining Pools

Mining pools are collaborative groups of individual cryptocurrency miners who combine their computational power to increase their chances of successfully mining blocks and earning rewards. Here’s an explanation of the concept and the benefits they offer to individual miners:

Concept of Mining Pools: In cryptocurrency mining, the process of solving complex mathematical puzzles to validate transactions and add them to the blockchain requires significant computational power. This process can be highly competitive, and the chances of an individual miner solving a puzzle and earning a reward are relatively low, especially as the mining difficulty increases.

Mining pools address this challenge by bringing together the computational resources of multiple miners. Instead of each miner working independently, they pool their processing power, collectively increasing the odds of successfully mining blocks. When a mining pool successfully mines a block, the rewards are distributed among the pool members based on their contributed computing power.

Benefits for Individual Miners:

- Steady Income: Mining pools provide a more stable and predictable income for miners. While individual miners might experience sporadic rewards, being part of a pool ensures more consistent payouts, even if they are smaller.

- Reduced Variability: Cryptocurrency mining can be subject to a lot of luck due to the randomness of finding block solutions. Mining pools reduce this variability, ensuring that miners receive rewards at a more regular rate.

- Increased Chances of Earning Rewards: Joining a pool significantly improves the chances of earning rewards. The combined computational power of all pool members increases the likelihood of successfully mining blocks.

- Lower Entry Barrier: Mining pools allow smaller miners to participate and earn rewards without having to invest in expensive and specialized hardware. Even miners with less powerful equipment can contribute to the pool’s overall hashing power.

- Regular Payouts: Mining pools often have set payout schedules, ensuring that miners receive rewards on a consistent basis. This can be preferable to waiting for individual block rewards, which may take a while to materialize.

- Shared Costs: Mining involves electricity and maintenance costs. By pooling resources, miners can collectively share these costs, potentially making mining more cost-effective.

- Access to Expertise: Mining pools usually have dedicated administrators and technical support. This can be helpful for less experienced miners who might need assistance in setting up and maintaining their mining rigs.

- Variety of Cryptocurrencies: Many mining pools offer the ability to mine different cryptocurrencies. This flexibility allows miners to choose the coins they want to mine based on profitability and personal preferences.

However, it’s important to note that mining pools also have a few downsides. Pool rewards need to be shared among members, which can mean slightly lower individual earnings compared to solo mining if the pool charges fees. Additionally, some mining pools might become too dominant in the network, potentially centralizing mining power, which goes against the decentralized ethos of many cryptocurrencies.

List of reputable mining pools and how to join them

As of my last knowledge update in September 2021, here are some reputable mining pools for various cryptocurrencies. Please note that the status of mining pools can change, so it’s a good idea to research the current reputation and performance before joining any pool. Additionally, the steps to join a pool might vary slightly based on the cryptocurrency and the specific pool’s setup.

Bitcoin (BTC):

- F2Pool

- Antpool

- Slush Pool

- BTC.com

Ethereum (ETH):

- Ethermine

- SparkPool

- F2Pool

- Nanopool

Litecoin (LTC):

- Antpool

- F2Pool

- Litecoinpool.org

Bitcoin Cash (BCH):

- ViaBTC

- Antpool

- F2Pool

Monero (XMR):

- SupportXMR

- MinerGate

- Hashvault

Joining a Mining Pool:

The process of joining a mining pool generally involves these steps:

-

Choose a Pool: Select a reputable mining pool based on the cryptocurrency you want to mine.

-

Create an Account: Sign up on the mining pool’s website. You’ll need to provide an email address and create a password.

-

Configure Mining Software: Download and configure mining software that is compatible with the chosen pool. The software will ask for the pool’s address, your wallet address, and other settings.

-

Start Mining: Run the mining software, and it will connect to the pool’s servers. Your computer’s processing power will contribute to the pool’s mining efforts.

-

Monitor Your Earnings: Most mining pools have online dashboards where you can monitor your mining activity and earnings. You can see your hash rate, shares submitted, and payouts.

-

Receive Payouts: Once you’ve mined enough and the pool successfully mines a block, you’ll receive a portion of the reward based on your contributed hash power. Payouts are often scheduled or triggered once a certain threshold is reached.

-

Configure Payouts: Set up your payout preferences, such as the minimum balance required for a payout or the payout frequency.

Remember to research each pool’s fee structure, payout methods, and reputation. Some pools charge fees for their services, and these fees can impact your overall earnings. Additionally, be cautious about sharing too much personal information online and ensure that the pool’s website uses secure connections (https) to protect your data.

Please verify the information above as the cryptocurrency landscape can change rapidly, and new mining pools might have emerged since my last update. Always consider recent reviews and recommendations when selecting a mining pool.